💡 Our Vision

At Geiser REI Services, we’re building more than homes—we’re building a portfolio of income-producing rental properties that generate long-term wealth and monthly cash flow. Our strategy focuses on acquiring undervalued properties, renovating them for maximum value, renting to qualified tenants, and refinancing to repeat the cycle.

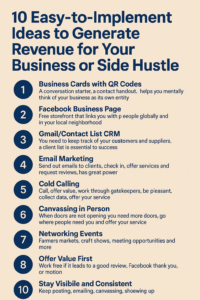

Geiser Home Buyers leverages a dedicated, local marketing system to consistently identify motivated sellers—eliminating reliance on the MLS or third-party wholesalers. By generating our own off-market leads, we maintain full control over acquisition quality, timing, and pricing. This direct-to-seller approach not only improves deal flow, it positions us as our own sourcing engine, reducing acquisition costs and maximizing ROI across every project.

Beaver Valley Construction and Handyman PA 161282 is the general contractor on all of our projects. She stands for inspections, pulls building permits, and works with design professionals like Architects, Engineers, and Subs for things like cabinets, granite, and flooring.

This proven process—known as BRRRR (Buy, Rehab, Rent, Refinance, Repeat)—has been used for decades by savvy investors to grow equity, generate passive income, and build lasting wealth.

🔨 Our Strategy: BRRRR

1. Buy – We source distressed or underpriced single-family and small multifamily properties, off-market or below value.

2. Rehab – We renovate with our in-house construction and project management team to increase appraised value.

3. Rent – We lease to qualified tenants using professional screening and management systems.

4. Refinance – We refinance based on the improved value, recapturing invested capital.

5. Repeat – We reinvest in the next project, compounding returns over time.

📈 Investment Options

We offer two investment structures to match your goals and risk profile:

✅ Private Lending (Short-Term Debt)

- 10–12% annual return

- Secured by first-position mortgage

- 12 month commitment

- Funds used for acquisition and renovation

✅ Equity Partnership (Long-Term Ownership)

- Preferred annual return + profit share

- Ownership in income-producing rentals

- Long-term appreciation + monthly income

- Completely passive — we handle everything

📊 Why Partner with Us?

- 20+ years of experience in construction, real estate, and project management

- Local expertise in Pennsylvania and surrounding markets

- Now Serving Toledo, Ohio

- Proven track record in fix & flips and rental asset stabilization

- Completed Projects List

- Vertical control over sourcing, renovations, leasing, and management

- Real assets with recurring income, equity growth, and tax advantages

🧱 What We’re Building

We’re not chasing quick flips. Our mission is to build a sustainable real estate portfolio backed by solid numbers and better systems. Whether you’re a passive investor or looking for secured returns, this opportunity is designed to deliver predictable outcomes in an uncertain market.

If your reading this and want to be part of what we are building lets talk. I have the experience and skillset, man power, and vision having seen what works and why. Everyone of the above deals has taught me lesson that are now part of the process. We have assembled all the resource sucking parts of the REI process and bring them under one roof. ROI increases through the elimination overhead and subcontracting costs. I’d be glad to explain further how we achieve this.

An investor alone, not in Pittsburgh, will typically pay an agent or wholesaler commission on the purchase. The renovation requires several different specialties trades and materials, and paying a GC 20% or more mark up or taking on that full time job. The lender will require points, and debt service at about 12%, $100K loan is $1000 mo. in debt service. While marching toward a refinance and another origination fee. The process is fairly fee heavy and relies on the low money down approach of using other peoples money. This works because many investor only look at the ROI and $35,000 after taxes and expenses still nets $25,000 and investors accept this as a reasonable return. We agree. However, economies of scale and becoming our own marketing funnel with a project management team positions us to earn significantly higher than average returns while increasing productivity across the board.

Our teams locates deals > We negotiate terms and price > Buy > Renovate > Refinance > Repeat

🛠️ Construction Control That Protects Your Investment

One of the biggest variables in real estate investing is renovation cost—and it’s where most deals go off track. At Geiser REI Services, we reduce that risk through strong relationships with licensed plumbers, electricians, and HVAC technicians, along with a deep bench of in-house construction staff.

How This Creates Value:

- ✅ Priority scheduling and trusted workmanship from established trade partners

- ✅ Accurate scopes and real pricing—not inflated sub bids

- ✅ In-house crews reduce labor markups and keep projects moving

- ✅ Experienced project oversight ensures jobs are done right the first time

- ✅ Resources managing our own construction allows for latitude in problem solving.

With over 20 years of hands-on experience in construction and remodeling, we don’t just subcontract and hope—it’s our system, our people, and our numbers. That means fewer surprises, tighter budgets, and stronger returns on every project.

📦 Expanding Into Self-Storage Development

In addition to our residential rental portfolio, we are actively exploring opportunities in self-storage development—a recession-resistant asset class with strong cash flow potential and scalable returns.

Self-storage offers:

- ✅ Low operating costs and minimal tenant turnover

- ✅ High demand in both urban and suburban markets

- ✅ Flexible lot requirements ideal for underutilized land

- ✅ Diversification from traditional residential assets

By leveraging our construction expertise, market insights, and access to off-market land opportunities, we aim to develop and hold self-storage facilities as long-term income-producing assets. This vertical enhances our portfolio with durable cash flow and additional equity growth.

📞 Let’s Talk

If you’re looking for a real-world investment opportunity with strong returns and long-term upside, I’d love to connect and see how a strategic partnership would benefit us both. Seeking partners to maximize the potential of deals on market and economies of scale.

📲 Call Marcus R. Geiser Sr. at 412-401-5883

📩 Email: marcusrgeiser@gmail.com

🌐 Contact Us to request a current project summary or schedule a consultation.